SAP Global Trade Services

Global trade compliance is a topic that many shippers leave to their custom broker or LSP to handle. Many shippers do not realize that managing their risk exposure or non-compliance can be done already in their systems (either ERP, TM, or EWM) and GTS may be enabled within the embedded S/4 core installation. That brings already large benefits. On the other hand, there are many opportunities being open by Preferential agreements, that shippers and exporters do not use or cannot utilize because of a lack of robust performing tools. GTS is an option in this field.

concircle advises and supports you in both basic and advanced use cases of Global Trade Compliance.

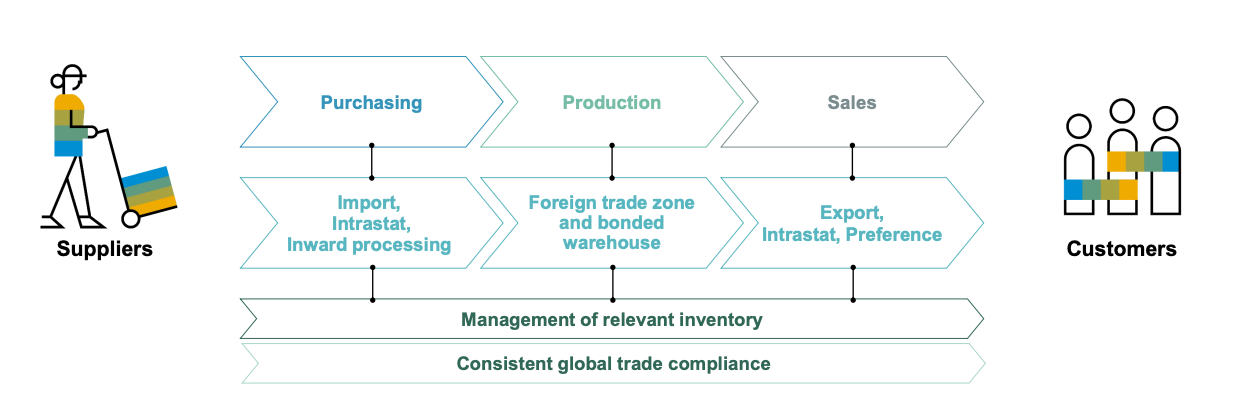

Functions

Export Management

Screen for restricted parties, manage export licenses, and export complete documentation, limits, and warnings towards to the country or territory that you exporting to. Make sure who is your end-user and that your product is not deemed as dual-use item.

Import Management

Import duties management, pre-calculate your declaration, and landed cost, monitor your customs filing as well as import limits and import required documentation. This links closely to your transportation process. Collaborate with custom broker on timely resolution of import issues.

Foreign Trade Zone/Bonded Warehouse

Are you temporarily importing goods, re-processing them, or re-exporting to further geographies, then you need to be compliant with national regulations and need to file with local customs your pre-import statement, in-stock updates, re-export declarations to the last screw. Be compliant and make sure you have your customs record up to date for any audit pending.

Preferential Agreements (FTA)

Bi-directional or multi-directional free trade agreements and comprehensive trade arrangements are tools to support your export to some countries or source preferential suppliers for your materials and components. What is needed is information on your supplier declaration, your own bill of materials (BOM) and your outbound declaration that enable your buyer to claim preferential duties. For this to enable in scale you need to run robust and reliable engine for BOM qualification and certificate collection.

Customs Declarations

Prepare your declaration based on shipment, order, or invoice, verify its completeness against the national rules, and progress to file (either directly or via your brokerage house). Monitor the duties calculated vs binding tariff determined by customs authorities.

Jakub Ctvrtnicek

Senior IT Consultant – Logistics & Supply Chain

Do you have questions about this solution, please contact me for a non-binding discussion!

+43 676 9410192